Getting your prices right is essential. If they're too high, you'll put off potential customers. Aim too low and you'll throw away potential profit and risk making customers believe your products or services are inferior to higher-priced competitor goods.

You need to set an 'optimum' price, which allows you to maximise profit after your costs have been covered.

Do some market research

Having sound knowledge of your market - potential customers and competitors - is essential when setting prices.

You need to know how much potential customers are prepared to pay for your products or services. If they already buy similar products from someone else, find out why and how much they spend.

Also find out how much your competitors charge, but never simply match a price unless you know you can afford to. A competitor could have lower overheads than you. Conversely, if you're confident you're offering better quality or additional benefits, customers might willingly pay more.

Calculate a breakeven figure

When setting prices, you need to work out your costs. Begin with all 'variable' costs (e.g. materials, electricity, packaging, etc), which are linked to volume (i.e. the more you make or sell, the higher they are).

'Fixed costs' - often called overheads (e.g. rent, business rates and wages) - stay the same, regardless of volume. Work out what proportion of these must be covered by the product or service you are pricing.

Add your variable costs to your fixed costs and any research and development costs. Then you'll arrive at a 'breakeven' figure - the amount you need to recoup. Sometimes an overall breakeven figure is divided by volume to create a unit breakeven figure. Now it's time to think about profit. Two pricing methods are commonly used - cost-plus and value-based.

What is cost-plus pricing?

The cost-plus approach involves adding 'mark-up' to breakeven. Usually expressed as a percentage of total cost, knowledge of your market or industry norms can help you decide how much margin to add. Mark-up can be higher when demand is stronger, if competition is scarce or when costs are low.

Be aware of the limitations of cost-plus pricing. It assumes you'll sell every unit. If you don't, your overall profit margin will be lower.

What is value-based pricing?

Value-based pricing requires sound knowledge of how much value customers attach to a product or service, which could be significantly higher than cost.

Remember that, for services, value-based prices need to be structured. For example, if you are called out in the early hours, you should be able to charge customers more than for call outs during normal hours. You might also be able to charge more for weekend or holiday time call-outs.

Consider VAT and other factors

You might need to think how applying VAT will impact on your final price. Selling at odd values rather than whole pounds (e.g. £9.99 instead of £10) is a common ploy to make prices seem more attractive.

As part of your overall pricing strategy, you might keep margins modest on some products to gain higher margins on sales of others. You might need to calculate a separate price for different territories or types of sale (e.g. online or trade sales).

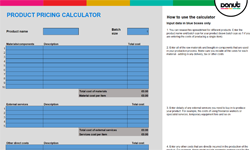

Free pricing calculator

Free pricing calculator

Setting the right price right is essential. Too high, and you'll struggle to make the sale. Too low and you're throwing away potential profit.

Make sure the price is right with our free product pricing calculator. Answer a few quick questions to work out what you should be charging.

Changing your prices

If your knowledge of your market leaves you feeling your calculated price is too high, to reduce it you must slim your costs. Protect your margins, wherever possible.

Generally speaking, setting a high price is better than going too low. Then if you have to make changes, customers will accept a price reduction much more favourably than an increase.

Remain agile and carry out regular price reviews. Your costs, customers and competitors can change quickly, which could well mean you need to alter your prices. Few prices remain fixed for long.